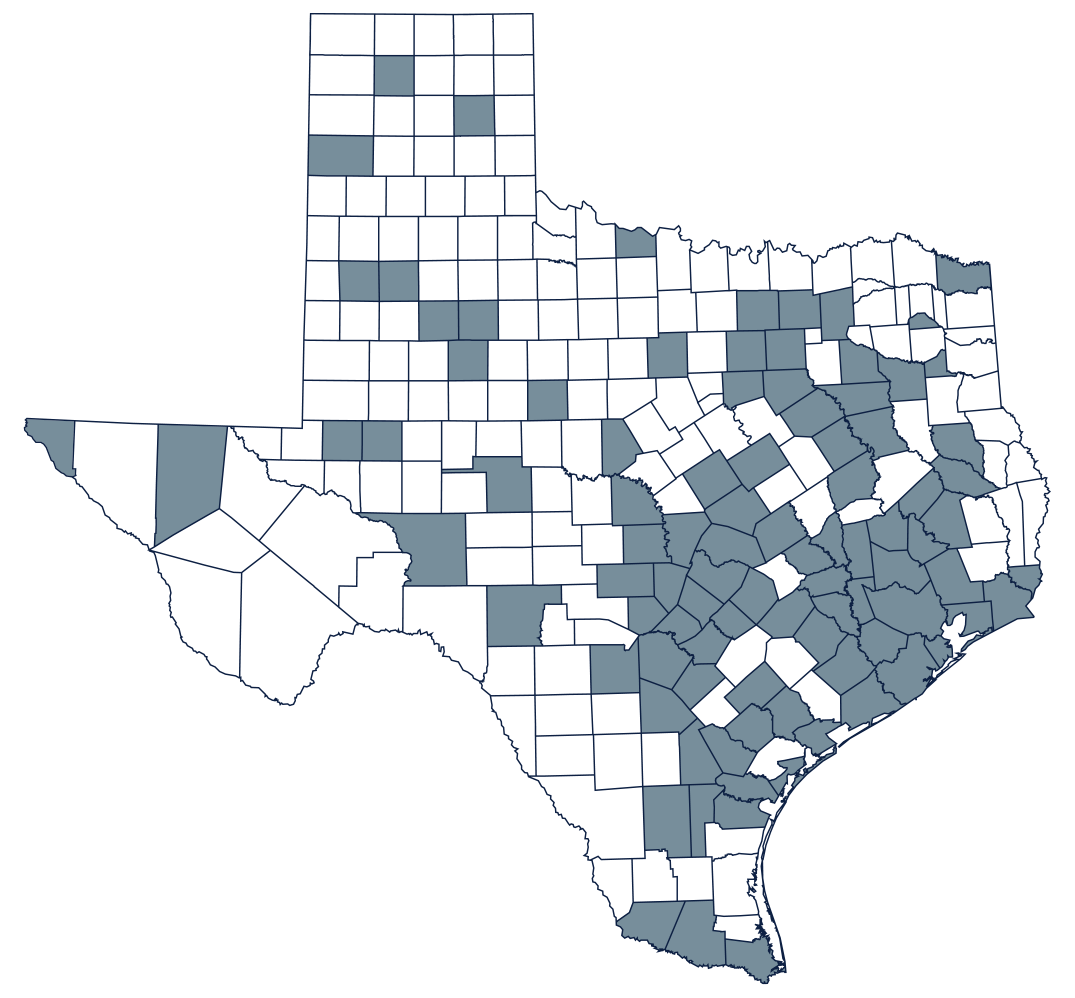

We are currently licensed to cover all counties in Texas, Arizona, Georgia, New Mexico, Colorado and Oklahoma.

Can you cover counties elsewhere?

Reach out to one of our agents and we will let you know if we can expand to your area (we most likely can!).

Based on the portfolio, Lane will likely charge a competitive contingency fee. Please send us a list of your properties for a quote. You are being charged on a contingency basis, so you don't pay Lane unless we reduce your property value and save you money. Flat fees may apply in some cases and different fees may apply if your property is recommended for arbitration or litigation.

Lane is well-versed in both commercial and residential parcels. All Lane team members handle both commercial and residential protests. Please note that we only accept residential accounts if they are in a portfolio of commercial accounts or a portfolio of multiple residential accounts.

We will identify the best possible approach(es) to value the subject property by assessing the income, cost, sales comparison, uniform and equity, land equity and rent equity. Our sister firm MBLane and Associates is a full-service commercial appraisal company that has been in business for over 20 years.

If notified, Lane will handle all correspondence and file forms such as name changes, exemptions and all other necessary paperwork to save you time. Please note that there may be an extra fee for filing exemptions.

MBLane and Associates, our affiliated sister firm, has been preparing commercial appraisals for over 20 years for properties throughout the state of Texas. Michael Lane, the founder, holds the MAI designation through the Appraisal Institute and is also a state-certified general appraiser. He has appraised commercial real estate in Texas for over 30 years.

Yes, the value of a residential or commercial property can increase by more than 10%. The only time the value cannot exceed a maximum increase of 10%, or 30% over a three-year period, is on a residential property with a homestead exemption.

Please note that this process changes from state to state.

Please Note: Your property value will be changed after a hearing is finished. Your value may not be certified for multiple months after the property was protested.

Call Lane and speak to an agent, or add/remove accounts through the client portal on our website.

As soon as possible, year-round.

Market Value – The value a property could be sold for in a competitive and open market.

Appraised Value – The taxable value is the market value with exemptions applied.

Follow the links below for some helpful resources regarding protesting your property taxes.

Texas Comptroller's Guide to Understanding the Property Tax Process