Commercial Property Tax Insights & Tools.

At Lane, we believe knowledge is power — and when it comes to your commercial property taxes, the right information can make all the difference.

We’ve gathered valuable commercial property tax insights, practical property tax tips, helpful forms and the latest property tax news together in one convenient place.

Whether you’re just beginning to explore the idea of a commercial property tax protest, have property tax questions about your specific situation or simply want to keep up with Texas market trends, you’ll find the commercial property tax insights and guidance you need right here, from folks who know this landscape.

Downloads

Guides and information sheets packed with property tax

tips to help you navigate the appeals process with ease.

Get Your Free Download!

Trusted Texas

Property Tax Help

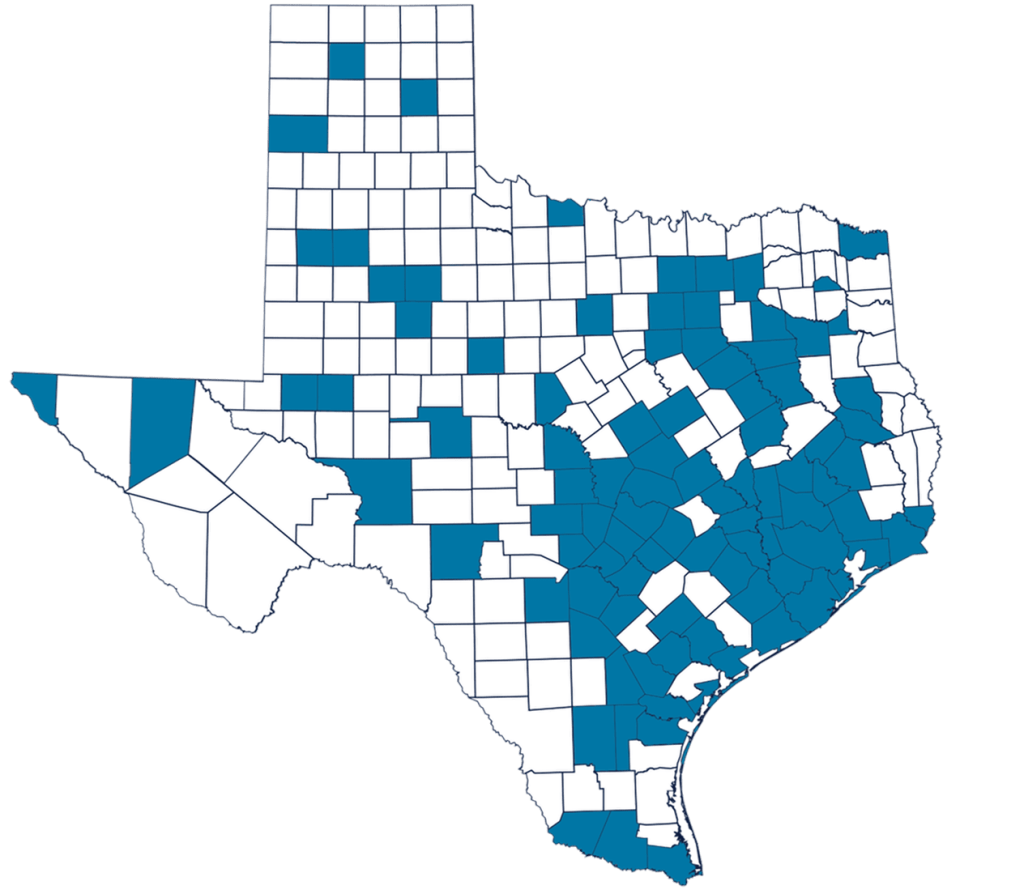

Lane is licensed to represent counties statewide and beyond, and currently represents properties in the following counties.

Anderson

Angelina

Aransas

Austin

Bastrop

Bell

Bexar

Bowie

Brazoria

Brazos

Brown

Burleson

Burnet

Cameron

Chambers

Collin

Colorado

Comal

Coryell

Dallas

Dewitt

Ector

Ellis

El Paso

Fayette

Fort Bend

Freestone

Galveston

Gillespie

Goliad

Grimes

Guadalupe

Harris

Henderson

Hidalgo

Jefferson

Jim Wells

Johnson

Kendall

Leon

Llano

Lubbock

Matagorda

McLennan

Medina

Midland

Montgomery

Nueces

Orange

Polk

San Jacinto

San Patricio

Scurry

Smith

Starr

Tarrant

Taylor

Tom Green

Travis

Trinity

Tyler

Victoria

Walker

Waller

Washington

Webb

Wharton

Wichita

Williamson

Wilson

Frequently Asked Questions

Let us break down the commercial property tax protest process, tips for uploading

information and what you should know to position efforts for success.

We are currently licensed to perform property tax protests in all counties across Texas, Arizona, Georgia, New Mexico, Colorado and Oklahoma. Need assistance elsewhere? Contact our team and we can let you know if we can expand to your area. (We typically can!)

Although it depends on the portfolio, Lane typically charges a competitive contingency fee. Through this approach, you don’t pay Lane unless we reduce your property value and save you money. Flat fees may apply in some cases, and various fees may apply if your property is recommended for arbitration or litigation. Please submit a list of your properties for a quote.

Although Lane used to handle residential property protests, we now exclusively deal in commercial property tax services. We are, however, happy to recommend firms that still assist with residential properties. Contact our team and we’ll put you in touch.

We determine the best approach to valuing your property by analyzing income, cost, sales, and equity factors. Our sister company, MBLane & Associates, brings more than 25 years of full-service commercial appraisal experience to support that process.

If notified, Lane will handle all correspondence and file forms such as name changes, exemptions and all other necessary paperwork to save you time. Please note that there may be an extra fee for filing exemptions.

There are three things our team needs to get started.

Letter of Agreement & Exhibit A

- By signing this, you agree to the discussed contingency fee for all tax savings

Appointment of Agent

- By signing this, you allow Lane to be your agent, representing you at hearings and negotiating your property value on your behalf.

Property Information Request

- Provide up-to-date property information throughout the year. Examples include property photos, repair estimates, proof of property damage, completed appraisals, rent rolls, and profit and loss statements. You can submit information quickly and easily through our client portal.

Please Note: Property Information Request information is not required for Lane to protest and represent you at a hearing, but it does help us achieve maximum savings.

Although Lane doesn’t perform appraisals, our sister firm, MBLane & Associates, has been specializing in such work for more than 25 years. Our founder, Michael Lane, holds the MAI designation through the Appraisal Institute and is a state-certified general appraiser. He has appraised commercial real estate in Texas for more than 30 years.

January 31: Property taxes are due for the previous year. It’s also your final deadline to file a correction.

May 15: This is the deadline to file a protest for the current year. Alternatively, you have 30 days after being notified by the county.

This process changes from state to state, but the following outlines Texas’ approach to property tax appeals.

- Once Lane is assigned as the agent, we file your property tax protest.

- The county appraisal district (CAD) creates an evidence package for the subject property.

- Lane obtains the CAD’s evidence and creates our own evidence package.

- Hearings are scheduled after May 15.

- Informal Hearing: Lane meets with a CAD appraiser over the phone or in person to discuss the valuation before a scheduled formal appraisal review board (ARB) hearing.

- Formal ARB Hearing: Lane and the CAD present evidence to the ARB, which then renders a decision. It works much like a standard court proceeding, with the ARB acting as the jury handing down a verdict on whether your commercial property taxes will be corrected for that tax year.

- Arbitration or Litigation Filing: In instances where Lane does not believe the best value was reached in a formal ARB hearing, we file for arbitration or litigation.

Please Note: Although your property value will be changed once a hearing is complete, your value may not be certified for multiple months following a protest.

When hearings prove unsuccessful in lowering your property value to something we deem fair, proceedings can continue into arbitration or litigation. Here’s how they work.

Arbitration

Typically reserved for properties valued at less than $5 million

- Lane files protest

- Informal hearing

- Board hearing (if no agreement was reached during the informal hearing)

- Arbitration filing (if no agreement was reached during the board hearing)

- A 45-day negotiation period begins between Lane and the CAD after the Comptroller’s office accepts the arbitration filing

- Arbitration hearing (if the property was not settled during the 45-day negotiation period)

Litigation

- Typically reserved for properties assessed at more than $5 million, with value discrepancies upward of $200,000

- Lane files protest

- Informal hearing

- Board hearing (if no agreement was reached during the informal hearing)

- Litigation filing (if no agreement was reached during the board hearing)

- Settlement conference/open negotiations

- Court trial (if the settlement conference failed to result in a settlement)

Please Note: This is just a high-level overview of the process. Visit our blog for more in-depth explanations.

Call Lane and speak to an agent, or add/remove accounts through the client portal.

We recommend contacting our team as quickly as possible, throughout the year.

Yes, a commercial property’s value can increase by more than 10%. The only time the value cannot exceed a maximum increase of 10%, or 30% over a three-year period, is for a residential property with a homestead exemption.

Market Value: The value a property could be sold for in a competitive and open market

Appraised Value: The taxable value is the market value with exemptions applied

Video Library

Get answers to your property tax questions and gain a deeper

understanding of how the appeal process works.

Protest Your Commercial

Property Taxes with Lane

Commercial Property Tax

Litigation & Arbitration

Commercial Property Tax

Protest FAQs

Quick Links

Market updates, tax code information, where to pay your property taxes and other trusted sources for Texas commercial property tax insights.

Tax Process

Latest News

Market updates, tax code information, where to pay your property taxes and other trusted sources for Texas commercial property tax insights.